A stock analysis of the marketplace Etsy and the social media shopping network Pinterest, by one of my favorite wall street publications, Motley Fool, makes a great case for these platforms long-term and why it may be a good time, if a fit, to get your business on these platforms.

Depending on your type of business, both or either of these platforms may be a fit.

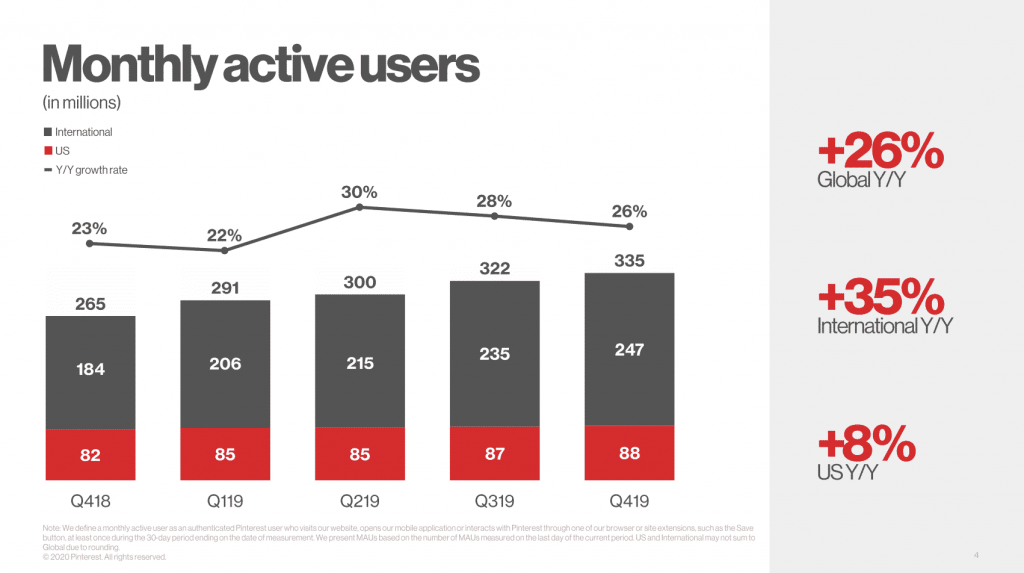

First, let’s talk about Pinterest. This is one, if not the largest social platform for shopping online, specifically for women.

Th Fool reports, “Revenue surged 58% higher from a year ago to $443 million. Net loss also narrowed to $94.2 million compared to a net loss of $125 million last year. Adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) was positive $93.0 million, as opposed to a meager $3.87 million in Q3 2019. Much like Etsy, Pinterest is turning a corner on the bottom line and could post even more dramatic profit expansion in the next coming years. To that I say “yes, please.”Â

Number of users and average revenue per user (ARPU) are closely watched metrics for the visual search company, and both of these areas did well in Q3. Global monthly average users grew 37% to 442 million, and global ARPU rebounded 15% to $1.05 after a rough go of it during the worst of the lockdown in the spring. Pinterest CEO Ben Silbermann and the top team apparently see the trend continuing given the call for about 60% revenue growth in Q4 during the busy holiday season. But what is most promising to me is that as these two metrics grow, Pinterest becomes an increasingly lucrative place for merchants and retailers to interact with customers.”

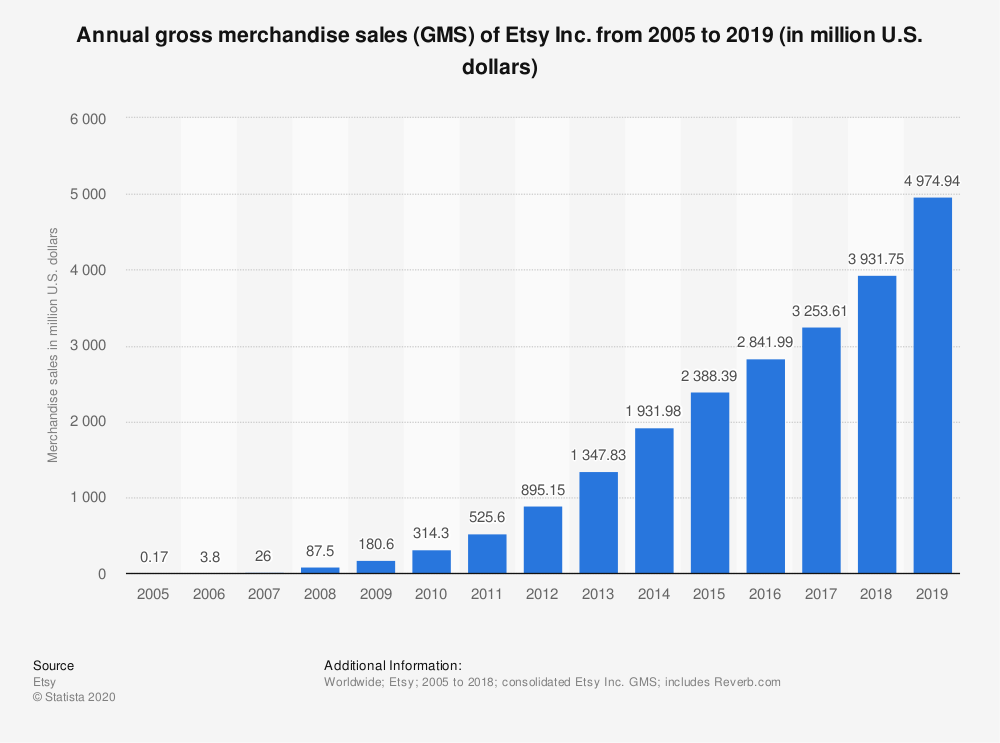

When it comes to Etsy, this is a marketplace that’s not really for all business, and more for independent sellers and brands. Nonetheless, more and more people are surprised by the growth Etsys had over the last few years and a legit player in the e-commerce space.

“The online marketplace for handmade goods reported another stellar quarter that topped management’s already-lofty predictions. Gross value of merchandise sold (GMS) on Etsy surged 119% higher year-over-year in Q3 2020 to over $2.63 billion (beating a prediction for 110% growth), leading to a 128% jump in revenue to over $451 million (predicted to grow 115% at the top of guidance).

To be fair, another monster quarter is already priced in here. After all, Etsy stock is up over 210% 2020 to-date, so the epic sales gains totaling growth of 102% through the first nine months of the year fall short of the stock’s rise in price. What accounts for the discrepancy? Etsy has turned a corner on the bottom line, and is now solidly in profitable territory. Net income is up 211% year-over-year through the first three quarters of 2020 to $201 million, including a massive 520% increase in Q3 alone.

The question now is whether Etsy can maintain this momentum through the all-important holiday shopping season. CEO Josh Silverman and company think it’s possible, calling for as much as an 85% increase in GMS and as much as a 90% increase in revenue from what was already a very busy Q4 2019 before COVID-19 struck.”

Etsy has more than 47 million buyers on its website. SimilarWeb.com ranks Etsy as the #11 e-commerce / shopping website in the United States with 341 million monthly visitors, which 62% of that represents U.S. visitors.

See if Esty is a good fit for your business. It just may be a great additional sales channel.