I think it would be unwise to ignore what’s happening in the world of cryptocurrency to our industry. I hope this article just serves as a glance to start thinking about how cryptocurrency can shape a different landscape for the world of e-commerce, where I would say is much needed, in my opinion. I would also say its inevitable there will be some adoption of crypto on a bigger scale than where we are now going into next year, that is 2022.

So, let’s just go through some things here.

THE CURRENT CHALLENGES OF THE CREDIT CARD SYSTEM FOR E-COMMERCE BUSINESSES

While I’m not an expert in the field of online payments, I have been in the e-commerce business space for over 20 years and have had my hassles in the space with a good understanding of the big issues (not all,) that we face with e-commerce businesses, as business owners, and those in finance teams. Let me list those I see as challenging, not in any particular order.

FRAUDULENT ORDERS: Fraudulent orders hurt more small businesses (and large ones as well,) then one might think. Even some of the better filters both on the platform side and credit card merchant sides allow fraud transactions to happen. And guess whose responsible for this…the business owner who has very little to no control on this transaction. It’s either cancel the order, or risk it.

Per digitalcommerce360:

“And the average number of both attempted and successful fraud attacks is up as well.

For U.S.-based ecommerce merchants specifically, the number of total fraud attempts per month is 344, up 24.2% from 277 in 2019. In 2020, 118 of those attempts, or 34.3%, were prevented compared with 156 or 56.3% prevented in 2019.

The new report, from research firm Nexis Lexis, surveyed 801 risk and fraud executives in retail and ecommerce in the U.S. and Canada just before and during the COVID-19 shutdown for its findings.

When looking at all U.S. merchants—both store-based and online—the cost of fraud is up 7.3% in 2020 from 2019. Every $1 of fraud now costs U.S. retailers $3.36 compared with $3.13 in 2019, Lexis Nexis says.

When looking at U.S. ecommerce merchants, $1 of fraud costs $3.73 in 2020 for mid-to-large ecommerce merchants selling digital goods, up 6.6% from $3.50 a year earlier. For mid-to-large online merchants that sell only physical goods, the cost is $3.38, up 8.7% from $3.11 in 2019. Lexis Nexis did not break out the cost of fraud for small ecommerce merchants. Small online retailers generate less than $10 million in annual revenue. Mid-to-large merchants sell more than $10 million worth of goods online, Lexis Nexis says.“

CHARGEBACKS: People don’t realize how EXPENSIVE a chargeback can be. Chargeback fees tend to range from $20 to $100 but with operation and customer acquisition costs, companies often lose 2 to 3 times the transaction amount. So, not only are you losing the merchandise and money during a fraudulent transaction, additional cost will eat away at these expenses with potential big impacts on your bottom line, again, more specifically hurting small to medium size businesses.

DIFFERENT FEES, DOMESTIC & INTERNATIONAL: Accepting credit cards isn’t as simple as thinking when you process a transaction you’re paying a locked in amount of whatever you agreed with the credit card merchant. Especially in the global landscape of todays e-commerce world, doing business worldwide means different fees for different credit cards which makes these transactions not only more expensive but harder to account for for accounting teams.

SECURITY: While most consumers are savy enough to understand that their finances are MOSTLY secured by the credit card companies they do businesses with, new security threats make it very uneasy for consumers to input data into websites they don’t know too well giving small to medium sized businesses yet another challenge in a space where there is no control on their side.

There are more challenges in this space for e-commerce businesses, however, in my experience, these are the hurdles that really cause issues and serious business interruptions that present real challenges financially and operationally. While we’re not moving from credit card transactions anytime soon as the main source of funding orders on the consumer side, why don’t we take a look of where crypto is today, on a granular level.

WHAT IS CRYPTOCURRENCY?

Cryptocurrency is a form of payment that can be exchanged online for goods and services. Cryptocurrencies work using a technology called blockchain. Blockchain is a decentralized technology spread across many computers that manages and records transactions. Part of the appeal of this technology is its security.

You store your cryptocurrency in a digital wallet or brokerage like Coinbase. Cryptocurrency got its name because it uses encryption to verify transactions. This means advanced coding is involved in storing and transmitting cryptocurrency data between wallets and to public ledgers. The aim of the encryption is to provide security and safety.

THE CURRENT LANDSCAPE OF CRYPTOCURRENCY IN E-COMMERCE

2020 was the year of COVID…the year of COVID brought about the rise of Bitcoin which brought back the cryptocurrency craze. However, for those who can remember 2016/2017, crypto was on the rise until Bitcoin went through its cycle and the trend really settled.

Today, cryto is hotter than ever. Most would tend to agree that while there has been and continues to be an incredible amount of ALTcoins, we’re seeing something that’s here to stay. With that said, I’m foreseeing this will bleed over into e-commerce as we have seen in some cases.

We have already started to see companies such as Tesla (and reportedly Apple considering,) keeping bitcoin on their balance sheet instead of cash (BIG BULLISH SIGNAL.)

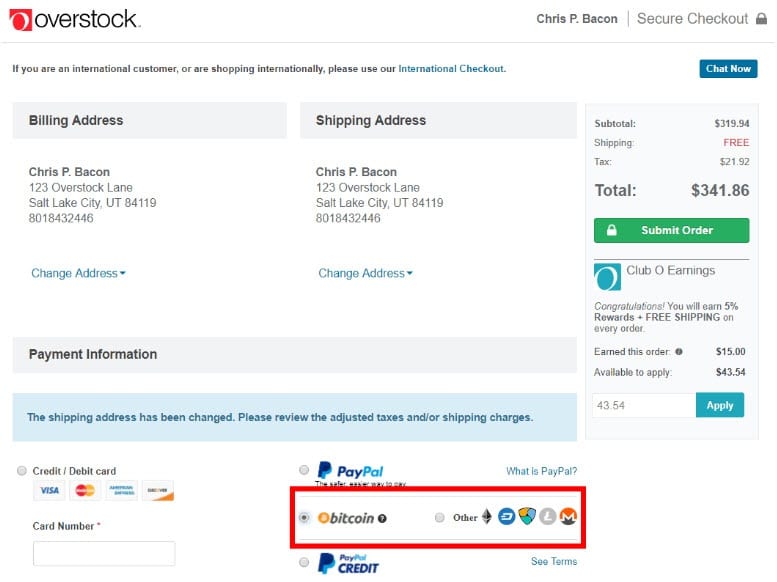

According to BuyBitcoinWorldwide, these retailers accept crypto as a method of payment (some indirectly):

- Microsoft.

- Overstock.

- Home Depot.

- Namecheap.

- Starbucks.

Update to the story on MAY 13, 2021 as it went live:

eBay is now the first e-commerce company to accept NFTs as a form of payment on its platform. With non-fungible tokens taking a big leap in popularity this year, the resale giant is now allowing sales of these collectibles, varying from sports cards to exclusive video clips. It also said it would possibly allow “blockchain-driven collectibles” further down the road. The move follows eBay’s announcement just last week it was open to exploring the idea of accepting cryptocurrency as payment.

BUT DOESN’T THE PRICE OF CRYPTOCURRENCY FLUCUATE TOO MUCH TO BE A VIABLE PAYMENT OPTION?

This is one of the big challenges for both businesses and consumers to grasp. I’m not going to pretend to explain how this will work out but I will give you my view.

#1: With rising popularity of cryptocurrency, mostly on the millennial side, they will want to paid AND be paid in cryptocurrency. The mass adoption of the coin of choice with more and more transactions happening may bring about a stable value OR be seen as a risk on both sides worth paying and accepting.

#2: Both consumers and businesses can transact by paying and accepting with coins that are pegged to an asset. Pegged digital currencies are those that are linked to the specific value of a bank-issued currency or other commodity. Tether is a popular example of a digital currency that is pegged to the U.S. dollar; one USDT token is always valued at $1.

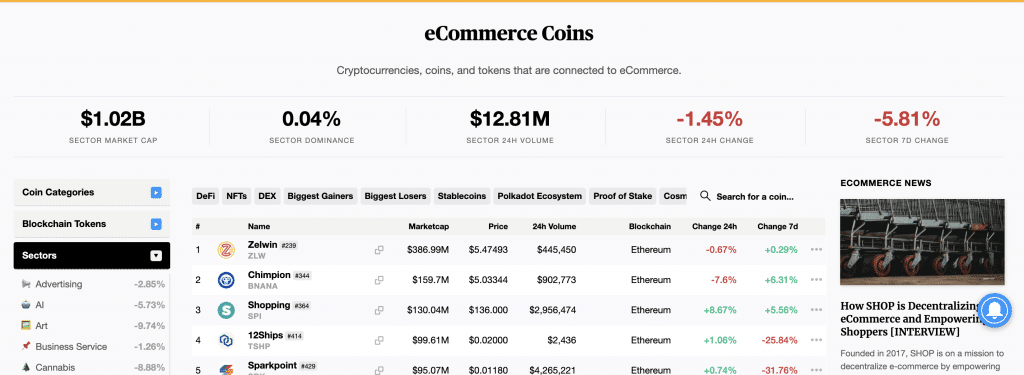

Some ALTcoins linked to e-commerce:

PROS OF CRYPTOCURRENCY ON COMMERCE AT A GLANCE

- PRO: Zero Chargebacks. One of the biggest risks for online stores is fraud and the cost associated with chargebacks.

- PRO: You Determine Transaction Fees (based on transaction speed which can actually be IMMEDIATE.)

- PRO: Security. Through blockchain technology, transactions CAN occur in a safer environment with more accountability.

SEE BELOW CHECKLIST.

There are cons, but here we listed three very quick pros that have real value to a business.

MASS ADOPTION IN CRYPTO ACCEPTANCE AROUND THE WEB

With merchants like PayPal making crypto payments available for individuals to pay businesses, this can change the game moving forward. You can read more about this here.

The more notable crypto merchant by name currently may be coinbase that allows businesses to create accounts. There is currently a waitlist and there are currently integrations with Shopify and Woocommerce, two platforms that take up a large marketshare of the e-commerce platform space that can service millions of businesses.

- Fast — Go live in minutes, not days

Free — No fees to accept crypto

Convert — Sell your crypto for cash or USD Coin

USD Coin & DAI — Accept price-stable cryptocurrency

Global — Tap into a global customer base

No Middlemen — Be your own bank

Irreversible — Chargebacks are a thing of the past

GREAT STATS on COINBASE:

Today, Coinbase has 56 million registered users.

Over 8k merchants already accept cryptocurrency