From our featured LINKEDIN post, where we take the best and most valuable information, today we are featuring a post from Maximilian Roast, Co-Founder of Klar.

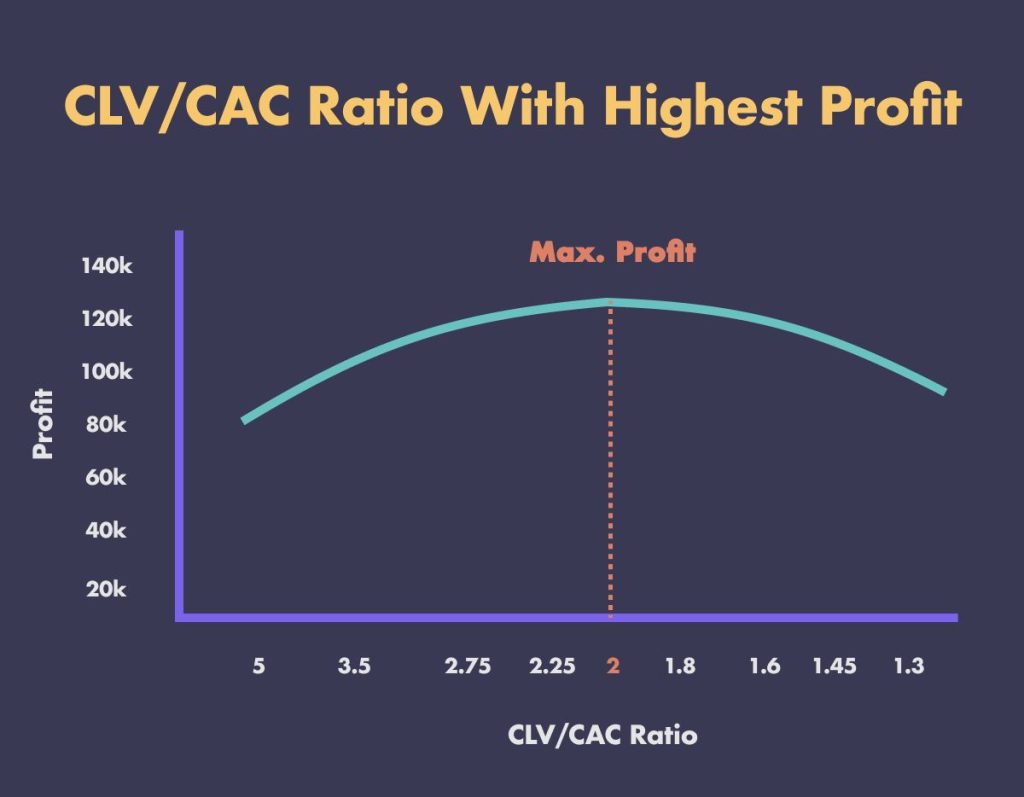

You might think that the higher your CLV is relative to your CAC the more money you will.

But that would be wrong.

Let’s look at the following example.

If you currently acquire 1.000 customers per month with a CAC of 20 and a CLV of 100, giving you a CLV/CAC ratio of 5.

That’s 80.000 in profit -> 1.000 * (100-20)

But by being so profitable, you could leave money on the table.

You don’t want to optimize relative but absolute margin.

Money in the bank.

Let’s build on this example.

Since you are so profitable, you start spending more on marketing.

This increases the number of new customers you can acquire but will also increases your CAC as efficiency tends to decrease as you scale spend.

Let’s assume that the growth in customers and growth in CAC are perfectly correlated.

So if you want to acquire 10% more customers, your average CAC for all customers will also increase by 10%.

In this case you could generate the most profit by increasing your CAC to 50 allowing you to generate 2.500 customers per month.

Now your CLV to CAC ratio is only 2 (100/50) and your profit per customer is down to 50.

A decrease of 37,5%.

But the total amount of profit you were able to generate in up to 125.000 (2.500*(100-50)).

That’s a 56% improvement and the benefit of using CLV to optimize for absolute profit.

You move the time horizon you optimize for from a single transaction to a more long-term view which allows you to increase absolute profitability.

So in theory, a CLV/CAC ratio of 2 would maximize profits.

Finding this sweet spot and with it your ideal CAC target is crucial so scale your business.

This is not a general rule but specific to the outlined margin structure and CAC to marketing spend relationship.

However, reality is unfortunately even more complicated and there are a lot more things that you need to consider to find the best CLV/CAC ratio.

Especially if you have a business that generates a significant percentage of its CLV after the first purchase of the customer.